Home »

Put your business in control with a member-owned group captive insurance alternative.

What is a member-owned group captive?

A member-owned group captive is an insurance company that provides insurance to, and is controlled by, its owners. Today, thousands of businesses throughout the United States have turned to a member-owned group captive insurance program. These programs serve a broad range of industries, empowering their members with the security and peace of mind that comes from greater control over their insurance destiny.

Unique benefits.

A member-owned group captive provides its members with empowerment and peace of mind. Specific benefits include:

- The potential return of underwriting profit via a dividend.

- Potential investment income earned in dollars in your loss fund.

- Enhanced loss control and risk management services.

- Long-term premium stability.

- Competitive overall premium.

- Enhanced claims management.

- Multi-state capabilities.

Who qualifies?

To qualify for a member-owned group captive, a company must show a strong commitment to safety, have above-average loss history, be financially sound, and pay a combined premium for workers’ compensation, auto liability/physical damage, and general liability/garage liability in excess of $100,000.

Target industries.

For those who qualify, a group captive insurance program may provide a long-term, stable mechanism to control insurance costs and cope with changing market dynamics. Target industries include:

- Manufacturing

- Automotive

- Trucking

- Health Care

- Contracting

- Food and Beverage

- Roofing Contractors

- Towing

- Wholesale and Distributors

- Restaurant Franchises

- Agribusiness

Insurance that gives your business more control.

Group captive insurance has nothing to do with kidnapping. Rather, it’s a completely different way for your business to insure against the unique risks you face. In effect, your business would set up a separate legal entity—a group captive insurance company—that acts as the insurer itself rather than taking out a policy with a traditional insurance company. Common reasons for doing this include:

- Covering risks that mainstream insurers don’t or won’t cover at a viable premium cost.

- Having greater control over insurance costs.

- Possible tax advantages.

- Removing the headaches of waiting for claims to be processed and the risk of payout disputes.

Benefits your business on multiple levels.

Legally, your business itself will own and control the group captive insurance company. In practice, it often makes sense to get outside help to oversee day-to-day management. This is partly to reduce the administration and bureaucracy involved and partly because managers can lend their insight on ways to potentially help improve the tax position and avoid any legal pitfalls.

Why join a group captive insurance company?

The insurance marketplace commonly goes through “hard” and “soft” cycles where premium fluctuations have little relation to individual loss experience. By pooling your resources and creating your own captive reinsurance company, these swings can be avoided, making your costs more predictable. Also, by pooling your resources, you can lower costs and retain investment income, both advantages your current insurance company retains.

Am I putting my company at financial risk by joining a group captive?

The simple answer is, no, you are not. If you were simply paying a premium into a fund in a bank and hoping your losses don’t exceed the fund, then yes, it would be very risky. Captive Resources’ client captives are structured properly, using a licensed and admitted insurance company rated A- or higher by A.M. Best, to act as the policy-issuing company and an equally strong reinsurance company to insure the catastrophic losses, so the risk is level and manageable. The captive only assumes risk in the smaller, more predictable layers.

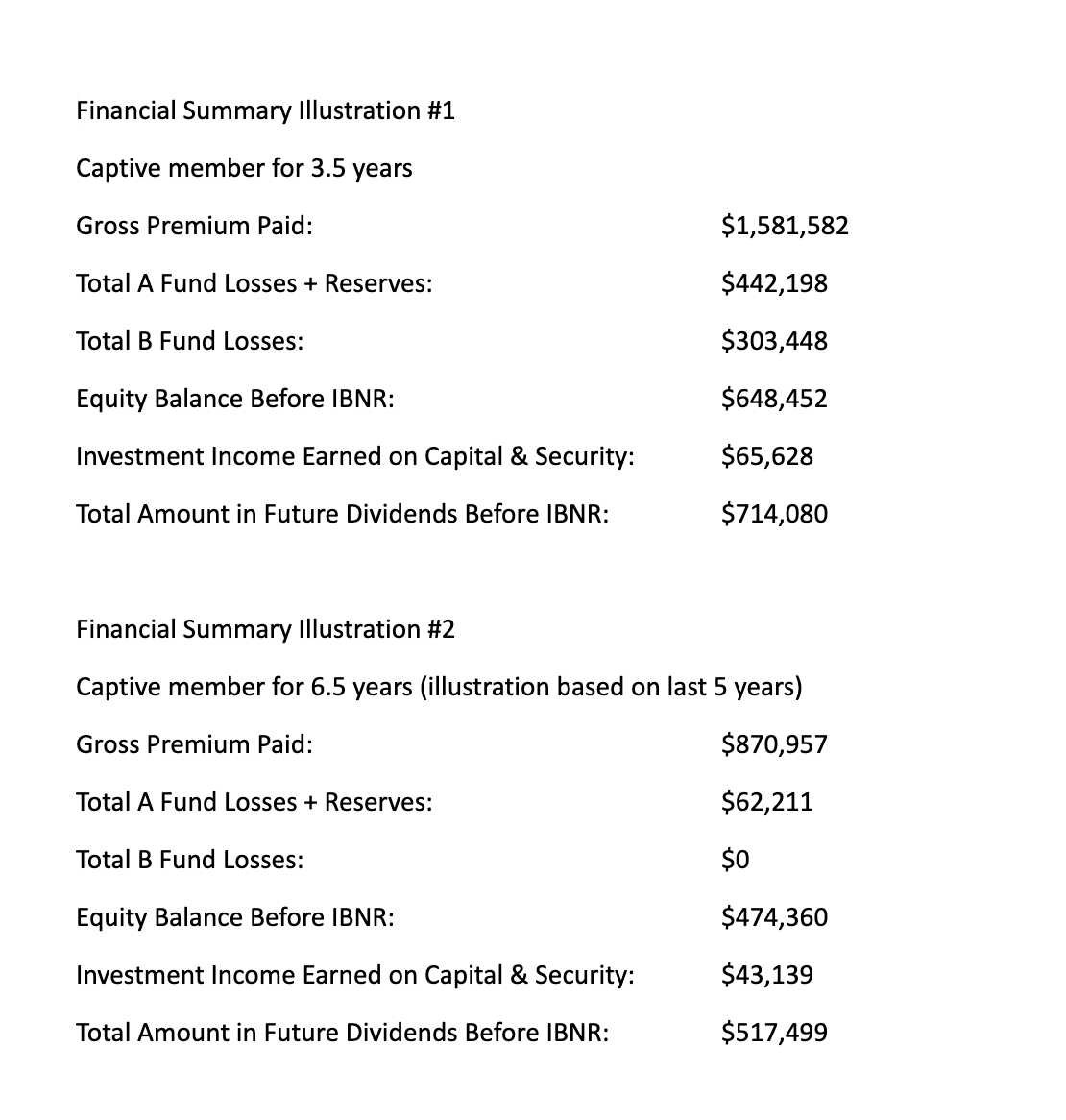

Assuming the captive is profitable, will there be dividends? If so, when? Will there be some relationship between loss experience and dividends?

When declared by the board of directors, members who have profits in their respective loss funds will have these profits returned to them along with any investment income earned for that policy period. Generally, returns begin three years after the end of a policy period; this is a decision of the board of the particular captive.

Will profitability (if any) result in a decrease in premiums rather than dividends?

Funding for losses is developed by the captive’s independent actuary. Over a period of time, generally three to five years, captive pay-in premiums should decrease if losses are less than the amount being funded. Conversely, if losses exceed funding, premiums will need to be increased. If the captive board of directors declares a dividend from a particular member’s loss fund, members may choose to use this cash toward the premium.

What problems will be addressed by Captive Resources that are not addressed through the normal insurance marketplace?

Captive Resources and Arbor Insurance Group develop specialized loss control programs tailored to members’ unique needs, special handling instructions for each member’s claim and unique coverage forms not available through the standard marketplace.

How are premiums developed?

Premiums are developed based on the last five years of your company’s historical information. A few major components include the last five years of loss history, the last five years of exposures, and the last five years of premium history. Unlike the conventional marketplace, your premiums are not developed based on carrier performance, industry performance, and losses; rather, premiums are developed primarily on your own company’s performance which, many times, may result in lower pay-in premiums than the conventional market.

If you think group captive insurance could work for your business or would like to learn more about it, contact us to discuss how we may be able to help.

Let’s Get Started

Captive Insurance Information Request

"*" indicates required fields

Don’t like forms? Contact us at 484-664-2328 or email us.